Editor’s note: This case study was originally published in June 2020. It has been updated for accuracy and to reflect modern practices.

In digital marketing, you never make promises you can’t keep or set goals you can’t reach.

But, in some cases, ad copy, the right messaging, and the perfect opportunity all line up to produce results that blow away any conventional expectations.

In this blog, we’re sharing an incredible Facebook Ads case study about a former client of ours, Seltzer Goods. They’re a B2C brand that sells uniquely inspired home goods for modern living.

Like most businesses at the start of the COVID-19 crisis, they saw a sharp drop in orders. But, instead of pulling back, they decided to double down and increase ad spend during this time — leading to substantial results, including:

- 9.68x return on ad spend (ROAS)

- 785% increase in monthly revenue

- $4.87 cost per customer acquisition (CPA)

But the success didn’t stop there. In addition to the improvements on the paid social channels, sitewide organic metrics increased significantly, too, with:

- 6.6% organic conversion rate

- 183% increase in monthly organic traffic.

- 931% increase in brand query and product searches

- 200% increase in non-branded search query impressions

Today, we’ll tell you exactly how we made it all happen — so you can replicate these results in your eCommerce campaigns, too.

Defining the Scope of the Project

Like many eCommerce businesses, Seltzer Goods was initially hit hard by the COVID-19 pandemic. Their challenge to our team: Create more sales from their B2C products to offset the negative effects on their wholesale business.

Fortunately, Seltzer Goods’ products lent well to the stay-at-home orders during early 2020, especially their artistically unique jigsaw puzzles.

The brand had the right products and plenty of inventory to make a splash; it just didn’t have enough awareness of these products among consumers to create the desired sales.

So, we came up with a solution to drive the interest Seltzer needed.

The ingredients:

- 1 Facebook Ad

- 1 Instagram Ad

- Strong creative and ad copy for both

- A receptive (cold) audience

- Carefully scaled ad budget

Setting Up the Ads

Although Seltzer Goods had never run campaigns before on their Facebook Ad account, we knew paid social advertising would eventually be a key to their success. So, before we even began our engagement, our team added a Facebook pixel to the eCommerce site.

This gave us a major advantage: Because Facebook had been collecting data on purchasers and site visitors for months, we were able to hit the ground running when creating well-informed ads.

The Campaign

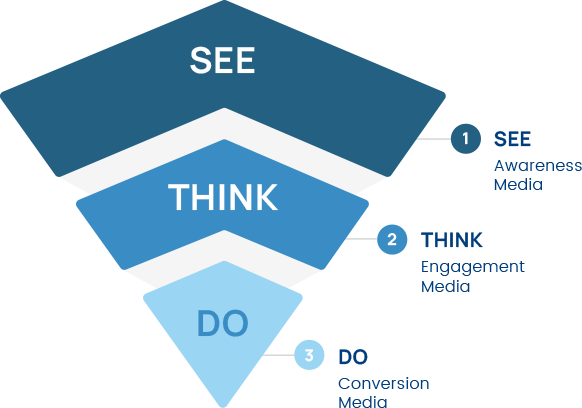

Here at Inflow, we believe in the power of the “See, Think, Do” Facebook Ad strategy. It’s served us extremely well when working with other eCommerce stores, so we used this framework for Seltzer Goods, too.

Because we wanted to reach new customers and see how they responded to our ad creative, we started with a single campaign that only targeted cold audiences (with no retargeting ads). By choosing a conversion-based approach optimized toward purchases, Facebook and Instagram would serve the ads to users who were most likely to take action — weeding out the window shoppers.

With this setup, we’d send more qualified shoppers into Seltzer Goods’ sales funnel from the very start.

The Ad Set

When creating an ad set on Facebook, it’s easy to get lost in all the options you can select.

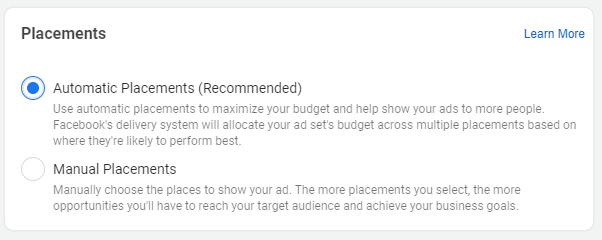

For Seltzer Goods, we kept it simple and opted into all devices and automatic placements. This would give Facebook and Instagram’s machine learning more options to display the ads, leading to better results for our client.

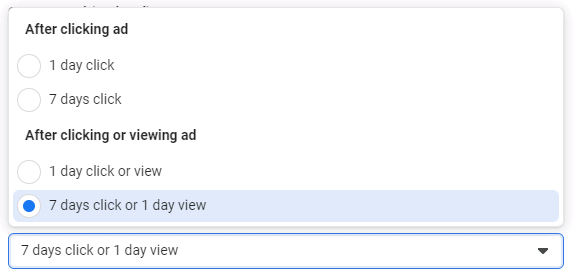

Given the lower price point of the product and the likelihood that consumers would impulse buy, we used a one-day click delivery optimization, instead of the default seven-day click optimization. (We recommend using the latter only if your product costs more than $100 or if your customers have a longer buying cycle.)

The Ad Set Targeting

For our audience targeting, we started with an interest-based audience ad set that was closely related to the puzzles we were selling.

Then, we quickly added in lookalike audiences for three segments of visitors that took action on the site:

- Key page visitors

- AddToCart users

- Purchasers (once the seed audiences were sufficient)

Having the Facebook pixel properly implemented and firing on key events such as ViewContent, AddToCart, and Purchase expedited the data collection on the seed audiences and built better lookalike audiences faster.

Pro Tip: Take note of the age of your lookalike audience. For example, a 14-day lookalike audience could look and behave dramatically differently from a 180-day lookalike audience, particularly during abnormal time periods such as pandemics, holidays, or Black Friday and Cyber Monday.

When implementing the lookalike audiences, we used the existing post ID from the interest-based ad sets. This allowed us to retain social proof (likes, shares, and comments) from the original ads, which would act as a positive signal to Facebook’s algorithm and potential buyers.

Next, we applied a clean and consistent naming convention structure from the campaign to the ad sets, the ads, and the UTM tagging on the back end of the URL. This streamlined our optimizations within the campaign and made reporting much easier.

Additionally, it allowed us to leverage the power of Google Analytics alongside the native reporting from Facebook Business Manager/Ad Manager, which is crucial in understanding your attribution models and entire audience journey.

The Budget

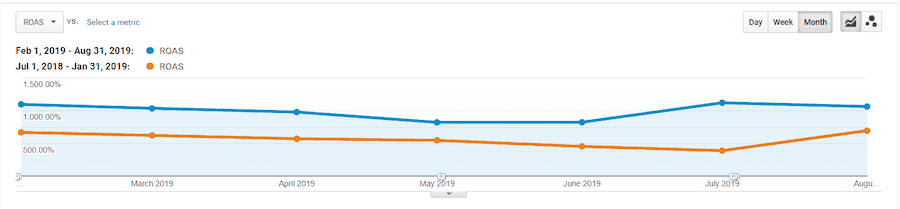

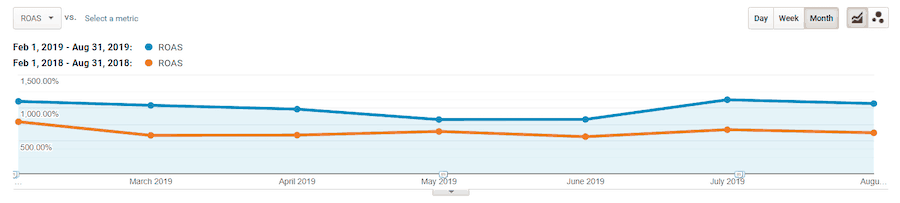

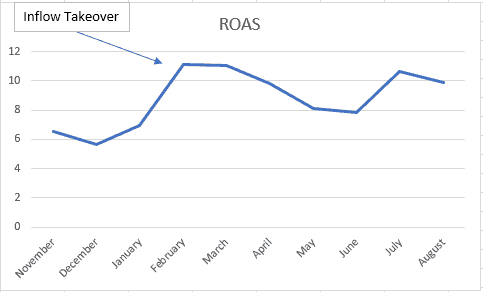

For the best Facebook marketing results, we recommend incrementally scaling your budget over time. In the case of Seltzer Goods, we scaled up budgets by 10–15% every couple of days, as long as the ROAS was at least 5x.

A more significant increase can wreak havoc on well-performing campaigns and hurt ROAS or cost per acquisition (CPA) metrics when Facebook has to quickly adjust to new information and determine the best way to serve it.

Breaking Down Our Ads

While targeting and budget are important for Facebook Ad success, you won’t get anywhere without first having an attractive, engaging ad.

Facebook A/B testing is key to creating an ad your target audience wants to see. By testing a few options, you can combine the best creative and copy to drive sales, rather than waste money running one ineffective ad at a time.

For Seltzer Goods, we started by running two different ad creatives against the same in-ad copy.

The Creative

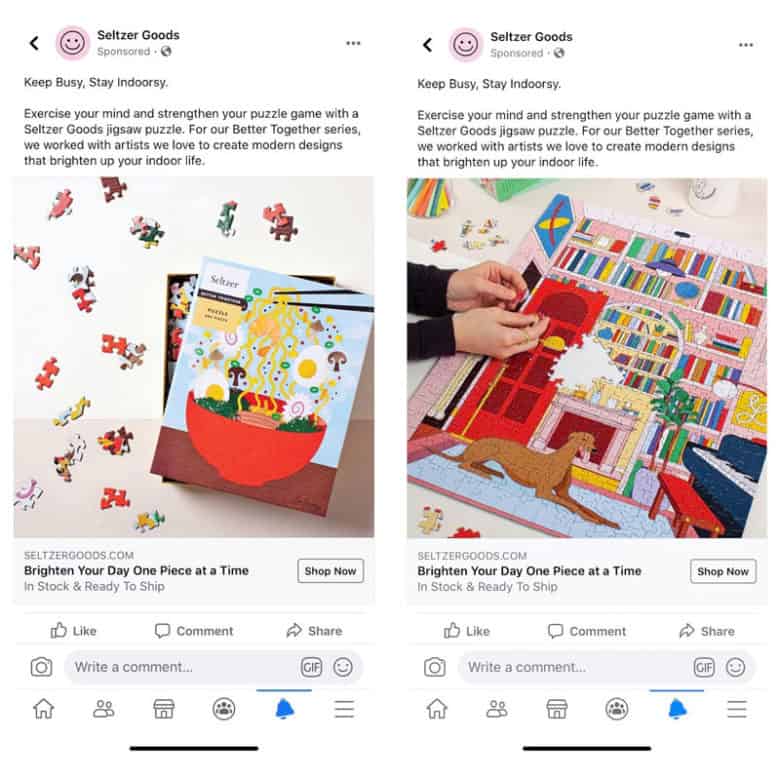

When creating our Facebook ads, we selected single-image ads in a 1:1 ratio.

Because the majority of social media consumption happens on mobile devices, the 1:1 ratio gives advertisers the best chance of showing the ads in an optimal format to a wider audience.

This particular creative captures the fun, bright, and artistic essence of Seltzer Goods’ puzzles and makes it an ideal choice for Facebook and Instagram advertising. By capturing the user’s attention, it stops the proverbial scroll and lends itself to a closer look.

Ad Creative #1:

Ad Creative #2:

Remember, your ad creative (image, video, or carousel) is the most important factor in a successful ad. It’s the one thing that is exclusively yours and the best way for your brand to stand out in the crowded social feeds.

The Copy

For this campaign, we chose to retain the same copy across both ad options for a few important reasons:

- It’s relevant. Seltzer Goods recognized the value of people staying indoors during the time period in which we ran the ad.

- It’s positive. Exercising the mind is something that everyone — from doctors and nurses to grandmas, aunties, and your seven-year-old nephew — can agree is good for you.

- It uses a natural call to action. The statement “Strengthen your puzzle game” is subtly woven into the text field and invokes a challenge to shoppers.

- It invokes a message of togetherness. Seltzer Goods’ Better Together series featured puzzles with modern designs from artists who meant something to the brand. It’s unique to Seltzer Goods, and, by highlighting this information in the ad, users had one more way to connect with the company.

- It uses positivity and hope instead of hard sales. The copy’s headline, “Brighten Your Day One Piece at a Time” is certainly not your standard ad headline (“Get Your Puzzle Today!” or “Hurry, Supplies Are Limited!”) — but it sparks more joy for purchasers in a time of stress and uncertainty.

- It emphasizes a quick turnaround. During a time when out-of-stock issues abounded, using the phrase “In Stock & Ready To Ship” reassured consumers upfront that Seltzer Goods’ products were stocked and ready to go.

Results & Takeaways

When it comes to paid social advertising, effective creative and copy are your not-so-secret weapons. Stay true to your brand, delight your customers with an ad creative, and you’ll win every time.

At the same time, scaling vertically and horizontally can also reap huge benefits. But you need good audience data to do it right.

The more recent your seed audiences, and the larger they are, the better lookalikes you can create — and the more sales you can drive through your campaigns.

Using these strategies, we saw great success with Seltzer Goods’ campaigns, including a 4.5x ROAS (9.68x ROAS with Facebook attribution) and less than $10 CPA ($4.87 with Facebook attribution).

In total, this campaign accounted for 25 percent of Seltzer Goods’ monthly revenue. Sitewide sales during this period, however, were equal to the total from the last seven months of sales — a 785% monthly increase.

So, what did it mean?

Our Facebook Ads campaigns didn’t just affect social revenue. It also affected other channels, too.

How Paid Ads Affect Other Channels’ Performance

After everything was calculated, Seltzer Goods’ paid social ads only accounted for 25% of the total revenue generated in this 30-day campaign.

That leaves another 75% of the generated revenue unaccounted for, which we can attribute to other channels — organic, direct, and referral traffic — that also experienced significant increases in performance.

In other words, Facebook and Instagram ads can (and often do) have a quantitative and qualitative positive effect on other channels, too.

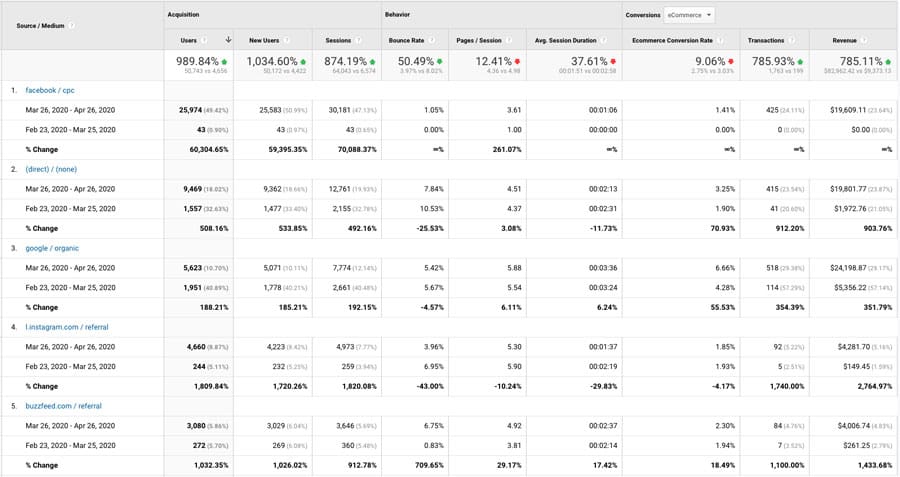

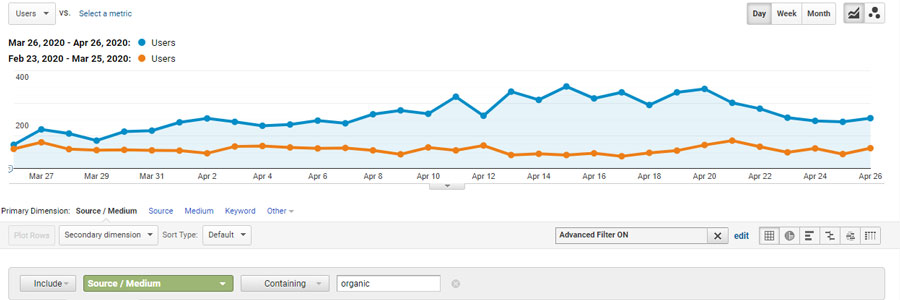

Below, you’ll see Seltzer Goods’ top-level source data for organic, direct, and referral traffic, comparing the first month we launched our initial Facebook campaigns to the month before.

In addition to the new cost-per-click (CPC) traffic, direct and organic channels skyrocketed in both traffic volume and conversion rate (185% to 533% and 351% to 903%, respectively), suggesting both an increase in demand and intent.

While we acknowledge that this particular time frame was opportune for puzzle vendors, we also know that no marketing effort exists in a silo. While other eCommerce clients have also seen increased demand, traffic volume, and transactions as a result of COVID-19, Seltzer Goods is a unique case — because the only marketing change we implemented was focused solely on Facebook and Instagram ads.

Increased Referral Traffic

Our paid social campaigns increased the exposure of not just Seltzer Goods’ puzzle products, but also the brand as a whole. With that increased awareness came backlinks and referral traffic from BuzzFeed and Architectural Digest, as well as a better-established social media presence for the brand.

Using Google Analytics, we also saw that some of the referral traffic (such as that from BuzzFeed) found Seltzer Goods through Facebook and Instagram ads. It was quality traffic, too; for referrals from BuzzFeed, users, conversions, and conversion rates increased by 1,206%, 1,001%, and 18%, respectively.

The trend continued when we examined the organic side of these social platforms. For example, the organic Instagram referral source saw an almost 1,700% increase in traffic and transactions — which speaks to an increased level of engagement and intent from the users consuming Seltzer Goods content.

Increased Organic Traffic

Google organic also showed strong improvement across the board. With a conversion rate of more than 6.6%, we wanted to dig a little deeper.

Below, you’ll see a comparison between organic traffic during the time period the ads were running and the previous period — a 183% increase in users.

At the same time, we saw:

- 105% increase in total brand impressions

- 319% increase in clicks

- 105% increase in click-through rate (CTR)

Naturally, we wanted to know what types of queries were surging in organic traffic. What we found was highly encouraging for anyone struggling to convey the value of Facebook beyond the platform’s attribution model.

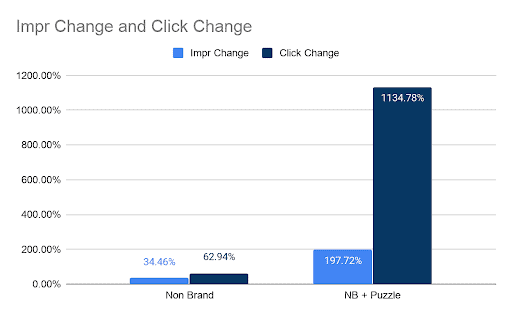

For analysis, we split the site’s organic search queries into two primary categories and subcategories:

- All Brand Traffic (“Seltzer Goods”)

- Brand traffic + product-specific mention (“Seltzer Goods” + “puzzles/pens”)

- Brand traffic + puzzle product-specific mention (“Seltzer Goods Ramen puzzle”)

- Brand traffic + product-specific mention (“Seltzer Goods” + “puzzles/pens”)

- All Non-Brand Traffic (“500-piece jigsaw puzzles,” “paper plants,” “seven-year pens”)

- Non-brand traffic with a puzzle product-specific mention (“Ramen Noodle Bowl puzzle”)

Upon slicing the data further, we saw impressions for “Brand Queries + Puzzle” jump 931%, with an 831% increase in clicks.

Even more exciting: The non-brand segment of puzzles showed nearly a 200% increase in impressions, accompanied by a 1,134% increase in clicks — the segment with the largest increase in CTR (315%).

So, not only did the paid social ads have an impact on the volume of branded search queries in the search engines, but they also had a remarkable impact on the intent of those queries (further reflected by the increased conversion rate).

While this is a smaller portion of traffic, it reflects the target market we were engaging and lends credence to paid social’s impact as a branding effort. Remember: There were no active SEO adjustments made during this time that would have had an impact on organic traffic.

This data is particularly encouraging for two reasons:

- It shows the correlation between strong paid social media campaigns and organic traffic from a brand-awareness, upper-funnel perspective.

- It demonstrates the correlation between a strong paid social media campaign and its impact on the bottom of the funnel.

Invest in Paid Social & Reap the Rewards

Let’s be honest: It’s very likely that Seltzer Goods would have seen an increase in puzzle sales, given the demand brought on by COVID-19.

However, without these strong Facebook and Instagram ads campaigns, the results would not have been as explosive across all digital channels.

This new brand awareness that led to links and brand searches probably wouldn’t have increased to such a degree, nor would we have expected the lifts in organic social, either.

It’s hard to parse the exact impact, but we strongly believe that we took a wave of potential performance and turned it into a tidal wave of sales.

Ultimately, Facebook and Instagram ads accelerated the incredible increase in traffic, expansion in traffic portfolios, and improvement in purchase intent. By combining relevant targeting and strong creative that embraces both the brand voice and the advertising platform’s capabilities, we were able to deliver the right message to the right audience at the right time.

All of these elements are critical in running a successful digital marketing campaign that has wide-reaching impacts across the entire digital ecosystem.

“Inflow helped us quickly increase eCommerce sales in the face of the COVID-19 pandemic. A multi-year strategy for growing sales and conversions was suddenly kicked into high gear. We really love their responsiveness, effort to understand our business, and determination to deliver the highest ROI possible.” — Gay Lam, Seltzer Goods

That said, this success wouldn’t have been possible without something worthwhile to advertise. With several products that radiate fun, brightness, and positivity, Seltzer Goods kept its advertising messaging and creative true to its brand. It delighted its customers by offering great experiences and first-class customer service, including handwritten notes with the purchases — all of which led to a COVID success story.

Follow this formula with your own brand, and you’ll win every time.

Want an expert to do it for you? Our team can create paid social media advertising strategies that impact your digital ecosystem, measure your results, and put you on a path for continuous improvement. Request a free proposal from us anytime to get started.

Read more of our Facebook Ads case studies below:

- How a Dual Paid Social & Search Strategy Earned Tactipup Record-Breaking Sales

- Furniture Facebook Ads Case Study: ROAS 0 to 29.5 in 3 Months

- How We Used Facebook Ads to Help Vitrazza Reach $1 Million/Month in Sales